What are the four stages of the business lifecycle?

Moving from the start-up phase into small business growth means your organisation will face several obstacles. To better define and prepare for these challenges business owners can look to the business lifecycle model.

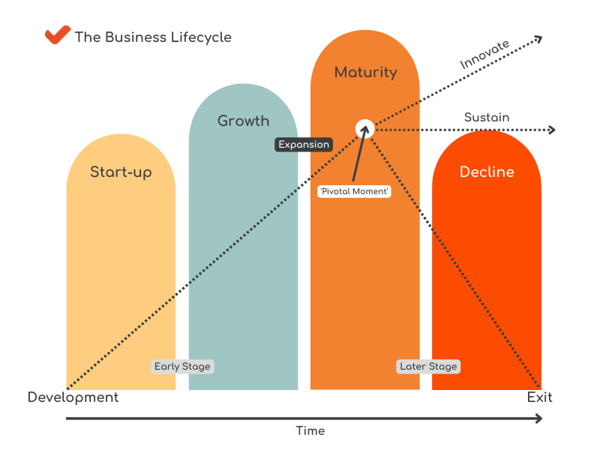

The business lifecycle is an important framework that outlines the different stages of a business from the moment it is created to its eventual decline.

Understanding your position in the business lifecycle will influence the strategic decisions you make and identify potential challenges associated with the various phases, this will help you better prepare to overcome possible road blocks and ultimately achieve sustainable growth.

This business model consists of four main stages that a business will pass through during their lifetime:

- Start-up - the company is focussed on proving its value proposition and generating revenue

- Growth - the company increases its customer base and builds out additional products or services to help scale further

- Maturity - follows growth as the company focusses on stabilising operations, managing costs and seeking new opportunities

- Decline - sales begin to fall and resources are reallocated elsewhere in order to maintain profitability

In this article you will learn about each stage individually, as well as how they relate to each other.

What is the Business Lifecycle?

The business lifecycle refers to the stages an organisation experiences throughout its lifetime, there are four phases: Start-up, Growth, Maturity and Decline. Each stage will impact the strategic planning and operations of a business.

How to Identify Your Stage of the Business Lifecycle

Ensuring success at every stage of your business journey is reliant on knowing what phase you’re in and what it entails, as well as what the next stage will be and how to get there. There are specific indicators in each stage that can help you identify where your business fits.

Stages of the Business Lifecycle

Stage 1: Start-up

You may have heard the phrase “fail to plan, plan to fail” - this quote is especially true when starting a new business. The start-up stage of the business lifecycle is often regarded as the most difficult and this is the time that most ventures fail.

Before reaching this stage, you’ve hopefully outlined your business plan describing your goals, strategies, and long-term objectives (even if it's just a rough draft).

A good business plan will help you think through all your options before jumping into action. As your organisation begins to scale, you'll revisit your initial plan throughout each phase of your business journey and that includes the ‘Start-up’ stage.

In this first stage of the business lifecycle the focus is on getting your newly established company launched and making quick (but informed) decisions. You're not so worried about making money, it’s more about building the right foundation to achieve future success.

This will be a busy and exciting time as you’re re-evaluating your offerings, establishing a system to increase sales and building brand awareness. With so many tasks to do and decisions to make there is a danger that your self-doubt may creep in making the early stages of operating a business confusing... but stick with your plan, you’ll do great!

Once you feel confident and your business begins generating income it's time to start thinking about how you will continue to grow your organisation. Consider key elements such as:

- Financing options

- Growing your team

- Investing in equipment

- Expanding your premises or relocating

Stage 2: Growth

Entering the 'Growth' stage you’ll feel like you have a good handle on running your business and you’re probably not doing it on your own anymore – you'll be delegating tasks to a larger team.

Five tell-tale signs that you’re in the ‘Growth' stage:

- You’re a boss now!

- You’re making quick decisions to keep up with rapid growth

- Your business is generating consistent income

- Your cash flow is improving

- Your customer base in growing

You’ll also be facing new challenges that you didn’t necessarily experience before:

|

|

|

|

When you're in business you’re constantly pushing forward - if not you’ll be going backwards! That means even if your organisation is established and doing well, you're not finished growing.

Two ways to grow your business for further expansion:

- Diversify revenue streams - your business will be more resilient if it has multiple revenue sources, so take time to think about ways you can add new products or services.

- Increase the number of customers and turnover - this can be done by improving your marketing and advertising, developing a new product or service, or breaking into a new market.

Analysing Your Competitors

An important part of expanding your business is identifying your competitors and evaluating what they’re doing right, and what you can do better!

As you observe what they are doing well, take note of how their strengths could help them compete against your business. If any of those strengths seem like potential opportunities for improvement or expansion on your part (such as increasing customer loyalty), develop strategies that will allow you to reach those goals more effectively than your competitor.

It would be a good idea to perform and SWOT analysis.

This detailed list of your strengths, weaknesses, opportunities and threats will give you better perspective of both your business and your competitors offering insight on how you can develop or improve your business’s strategy.

Stage 3: Maturity

Your investment (both time & money) has paid off!

At this point, you have a good understanding of your products/services and how they fit into the market, you’re seeing stable profits year-on-year, and you secured finance to build your team – including those with leadership skills to take on more responsibility. You’ve also learned a lot about customer needs, so now you can focus on delivering.

You'll reach the 'pivotal moment' of your business journey - now it's time to decide what direction to take your business and implementing a strategy to prepare for the future.

There are generally two choices for businesses to choose from: innovate to further expand or exit - we'll look more into these in Stage 4: 'Decline'. Regardless of your decision, in the 'Maturity' stage you will likely still be looking for any gaps in the market that you can fill strategically to increase profits for continued growth or to improve the value of your business if you're looking to sell/exit in the future.

Three ways to innovate and improve business value:

- Focus on driving innovation in order to maintain relevance in an increasingly crowded space.

- Improve internal processes to drive efficiency and cost savings for your business systems and operations.

- Deliver what customers want from their experience with your company. Think about product/service quality, competitive pricing, quick delivery times and customer service after purchase.

Stage 4: Decline

If you’ve decided that it’s time to exit your business you have entered the final phase of the business lifecycle. Despite the despairing name and negative connotations, the ‘Decline' stage can have plenty of opportunities to make money if you plan ahead of time.

It’s inevitable that all businesses eventually reach an end, whether that’s through sale, succession or closure, it’s natural for businesses to reach this last stage as they age. With the right strategy in place the process can be a small and gradual decline, or a large but well thought-through sudden one.

How can DSA Prospect Help?

The business lifecycle is merely a guide to help businesses anticipate the next step in their journey. Your business may not experience every stage, or encounter them in chronological order, awareness of each is crucial when planning for the future.

Knowing where you are in the business lifecycle is a great start, but you want to make the right decisions at each stage. Our team works closely with clients throughout their business journey whether they're:

- Starting a new business

- Moving into the growth phase and looking for advice

- Ready to implement an exit strategy

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.