Tax preparation vs. tax planning: Which one do I actually need?

Taxes can be a complex and ever-changing landscape for both individuals and businesses. While tax preparation and tax planning are both essential components of sound financial management, they each play a unique role. Understanding the difference between these two can save you time, money and a whole lot of stress.

Many taxpayers mistakenly think tax preparation and tax planning are the same thing, and there are a few reasons why they're often mixed up. One of the biggest factors is the emphasis that is put on tax season and Self Assessments.

It's common for people to prioritise tax preparation to ensure they get their tax return filed correctly and on time, often overlooking how planning ahead could save them money. It's easy to see why this happens considering tax prep gets all the headlines in the build up to the 31st of January - the big tax rush, the looming deadline, the impending penalties... you get the picture!

Even now you might be thinking, "Well, they both have to do with taxes, aren't they basically the same thing?" Not quite, here's why tax planning is different from just getting your taxes done and how to know which one you need.

What is tax preparation?

While filing a Self Assessment tax return to HMRC by the 31st of January deadline is the ultimate goal, tax preparation encompasses the entire process leading up to that point. The core objective is to ensure the accuracy of your income and expense reporting to the government, ultimately ensuring you pay the correct amount of tax.

What's typically involved in the tax preparation process?

- Gathering information: This step entails gathering documents that confirm your income, deductions, and tax relief/credits. Being well-organised throughout the year will make this part much easier.

- Completing your tax return: Filling out your tax return correctly is key to avoiding tax-related headaches. Our advice is always to start early and give yourself plenty of time to catch any mistakes or missed opportunities to minimise your tax liability. This goes for anyone working with an accountant too - the sooner we receive your information and start the process, the more time there is to potentially save you money.

- Submitting your tax return: Filing your tax return marks the finish line of the tax preparation process (well, at least until next year!). Before hitting submit on your online tax return and sending it off to HMRC before the deadline, take a moment to double-check all the information.

What is tax planning?

While tax preparation focuses on accurately reporting your past year's income and expenses, tax planning is the strategic, year-round approach to managing your finances and tax profile. It involves looking ahead and making smart decisions that can potentially lower the amount of taxes you owe.

Tax planning becomes particularly important in the following scenarios:

- Significant life changes: Going through major life events like getting married, buying a house, starting a business, or approaching retirement all have tax implications. Tax planning can help you navigate these changes and minimise their tax impact.

- Complex finances: If your income comes from multiple sources, you have significant investments, or own a business, tax planning becomes crucial. It helps you identify tax-saving strategies and ensure you're taking advantage of all available deductions and credits.

- High-income earners: If you fall into a higher tax bracket, engaging in tax planning and strategically managing your income streams, deductions, and investments can significantly reduce your tax burden.

- Planning for the future: Whether you're saving for retirement, a child's education, or a down payment on a house, tax planning can help you make the most of your hard-earned money.

What does tax planning entail?

|

|

|

|

Don't underestimate the value of tax planning, even for seemingly straightforward financial situations. Consulting a tax professional for advice can be a wise investment. Their expertise can help you navigate potential tax savings opportunities and hidden complexities you might have overlooked.

The key difference between tax preparation and tax planning

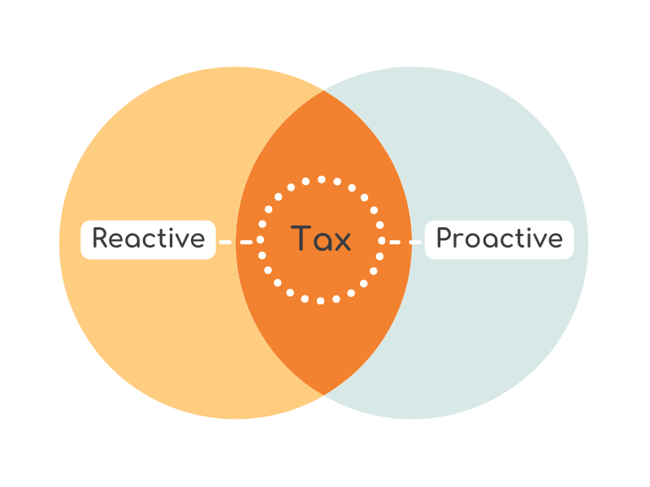

The key difference between tax preparation and tax planning lies in their approach - one being reactive and the other being proactive.

Tax preparation is essentially the act of putting all the pieces together to submit your tax return. It is a reactive approach that focuses on meeting your current year's tax obligations and paying what you owe to make sure you're compliant with the law.

On the other hand, tax planning involves taking a proactive approach to managing your finances year-round. The main goal is to reduce your tax bill when it comes time to file your Self Assessment by pinpointing deductions, credits, and other tax-efficient options. Additionally, it provides you with tools and strategies to navigate unexpected financial hurdles that may arise.

Why you need to know the difference...

While both tax preparation and tax planning play an important role, mistaking them as one and the same can result in missed opportunities to maximise benefits and minimise liabilities. By grasping this differentiation, you open the door to achieving long-term financial goals and securing a stable financial future.

As a key takeaway, remember that tax preparation is crucial for meeting your annual tax obligations. However, tax planning empowers you to go beyond simply filing a return. We encourage individuals and business owners to consider incorporating tax planning into their money management practices.

So, which one do you actually need? It all boils down to whether you simply want to complete your tax return or if you're interested in delving into your finances to discover potential savings. The best answer... you need both!

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.