The UK Mini-Budget: Important Tax Cuts and More Support

While the economical challenges surrounding inflation and energy fees remained relatively similar to what was discussed in Rishi Sunak's Spring Statement, the current Chancellor announced a list of new support measures to boost economic growth in the UK Mini-Budget on 23 September 2022.

| Please note a number of these budgetary announcements have been revised following the Chancellor Jeremy Hunt's statement on the 17th October 2022. Read our summary of the most recent emergency budget here. A full Medium-Term Fiscal Plan will be delivered on 31 October 2022. |

With inflation sitting at 9.9% and energy giants looking to charge massive fees, Chancellor Kwasi Kwarteng's emergency budget highlighted important tax cuts and more support for households and businesses while the cost of living and energy crisis continues into the winter months.

There were high expectations for today's announcements and as the biggest tax cutting budget since 1972 the question is, will the government's estimated £100 billion - £200 billion support package help people save money and businesses start investing again?

The mini-Budget largely focussed on a 'growth plan' and Chancellor Kwarteng's 2.5% annual growth target; though that may be difficult to achieve considering the current initiatives to cap energy bills and cut taxes will most likely have a short term effect on economic performance.

There were three main themes underlined today: growth, tax and regulation.

Key Budget Announcements and Highlights:

- Health and Social Care Levy Reverse

- Income Tax Cut

- Corporation Tax Increase Scrapped

- Energy Price Guarantee & Energy Bill Relief Scheme

- Stamp Duty Cut

Health and Social Care Levy Reverse

It's no secret that the new Prime Minister, Liz Truss was not a supporter of the 1.25% Health and Social Care Levy which was initially implemented in April 2022 as a National Insurance increase.

Mr. Kwarteng announced that from November this NI increase will be reversed and reverted back to the 2021 - 2022 rates. While the rate reversal will put some money back into taxpayers pockets, higher earners will be the biggest benefactors.

Highlights of the announcement:

- From 6 November 2022 the 1.25% National Insurance rates increase will be reversed

- The Health and Social Care Levy which was meant to be introduced as a separate tax in April 2023 has been scrapped

- The reduced NICs are projected to save taxpayers an average of £330 a year

Income Tax Cut

In the 2022 Spring Statement, Rishi Sunak announced that people would be able to keep more of what they earn by the government cutting the basic rate of income tax by 1%; however, this was not set to happen until 2024.

There was much speculation about Kwasi Kwarteng accelerating this plan and it was confirmed today that the government will bring this proposal forward and cut the basic rate of income tax from April 2023.

Highlights of the announcement:

- Basic rate of income tax to be cut from 20% to 19%

- The change will be happening 12 months earlier than planned

- Employers, savers and pensioners will gain an average of £170 in the 2023 - 2024 tax year

- Dividend tax rates to be reduced by 1.25%

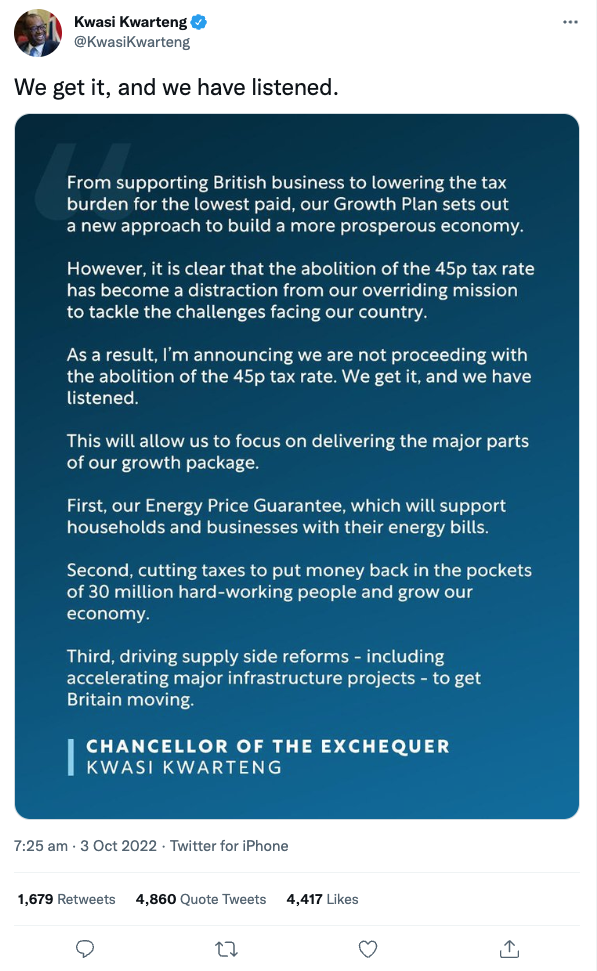

- While the Chancellor originally announced that from April 2023 the 45% additional rate of income tax would be withdrawn, on 3rd October 2022 he posted on Twitter "We get it, and we have listened" sharing that the higher rate tax cut would not be implemented as it became a 'distraction'

"Economic growth means more jobs, higher wages, and more money for schools & the National Health Service."

- Chancellor Kwasi Kwarteng

Corporation Tax Increase Scrapped

A rise in Corporation Tax was set to take place from April 2023, increasing from 19% to 25%.

With the Prime Minister and Chancellor's focus on stabilising growth in the economy, they announced the cancellation of the increase tp the main rate of Corporation Tax meaning it would remain at 19%.

Chancellor Kwasi Kwarteng said this would, "support business investment and help economic growth" and put ""£19 billion back into the economy".

However, Liz Truss reversed the government’s plans to freeze Corporation Tax at 19% and announced on 14 October 2022 that it will in fact increase to 25% from April 2023.

The Energy Price Guarantee & Energy Bill Relief Scheme

The rising energy costs have been a big concern for individuals and businesses, particularly when it was released that bills were set to rise to £3500 as the UK enters the autumn and winter months.

The Prime Minister previously announced a £150 billion energy bill support package, including the Energy Price Guarantee (EPG) capping energy costs from 1 October - cutting what the average household is expected to pay to no more than £2500.

While this was welcomed news by families across the UK, businesses have been waiting for government intervention to address their increasing energy rates. The Chancellor has announced the details of a six month Energy Bill Relief Scheme (EBRS) that will support businesses, charities, and public-sector organisations starting from 1 October 2022.

Highlights of the announcement:

- The Energy Price Guarantee (EPG) will limit the price consumers pay for electricity and gas for two years beginning in October 2022

- Energy bills for the average household will be limited to £2500; although savings will vary depending on the household

- The £400 Energy Bills Support Scheme (EBSS) will also be going ahead to support with energy costs over the winter months

- The Energy Bill Relief Scheme (EBRS) has been introduced to support businesses, charities, hospitals and schools with rising gas and electricity bills through a discount on wholesale energy prices for six months

- The EBRS will begin in October 2022 and be reviewed after March 2023

- HM Treasury and the Bank of England have initiated a £40 billion Energy Markets Financing Scheme to help energy firms

Annual Investment Allowance

With the Super-Deduction expiring soon, companies will no longer be able to benefit from this investment incentive. What is the the new plan to boost capital investments?

The Chancellor announced that the £1 million level of the Annual Investment Allowance (AIA) which was ending after 31 March 2023 will become permanent from 1 April 2023.

Highlights of the announcement:

-

The Annual Investment Allowance supports business investment between £200,000 and £1 million and provides tax relief on assets qualifying as plant and machinery

-

Businesses can deduct the full value of the qualifying cost up to £1 million in the first year

Alcohol Duty Cancelled

The planned increased to duty on beer, cider, wine and spirits has been cancelled. Alcohol duty will be frozen from February 2023.

Stamp Duty Cut

While there has been much debate on whether or not a cut to Stamp Duty will help boost the economy, Kwasi Kwarteng announced that effective immediately Stamp Duty charges will be cut to reduce the tax burden on people buying a home - including benefits for first-time home buyers.

Highlights of the announcement:

- The Stamp Duty Land Tax (SDLT) threshold has increased, no Stamp Duty will be paid on properties purchased under £250,000 (previously £125,000)

- First-time home buyers will now pay SDLT from £425,000 (previously £300,000)

- First-time buyers relief has also increased from £500,000 to a maximum of £625,000

Additional Announcements:

- Company Share Option Plan (CSOP) limit has been doubled to £60,000

- Firms can now raise £250,000 under the Seed Enterprise Investment Scheme (SEIS) and the criteria has been expanded

- Cap on bankers' bonus has been scrapped

- Planning restrictions to be relaxed with a new bill

- Introduction of 40 low-tax investment zones in England

- Changes to Universal Credit rules, the Chancellor has stated that people receiving this benefit will need to:

- Meet regularly with their work coach

- Take steps to increase their earnings

- Face benefit reductions if commitments are not met

- IR35 rules will be simplified

- VAT-free scheme for international tourists that will be supported with a new digital system

Are tax cuts the solution?

During the early stages of her campaign Liz Truss pledged to start cutting taxes if elected, highlighting her belief that tax cuts will ultimately stimulate the UK's economic growth. It's clear that the PM and Chancellor want to put more money back into the economy by creating the right conditions to encourage investment.

While tax cuts will free up some money for individuals and business owners working their way through rising costs, today's announcements resemble a 'quick fix' and for a long term solution a review of the current tax system and government policy is needed.

Perhaps this is something we can we expect to hear more about in the next Budget.

How can DSA Prospect help?

Please keep in mind that more news on these announcements will continue to develop and this is a merely a guide to some of the main points initially discussed.

We recommend seeking further consultation on any questions you may have regarding the 2022 emergency mini-Budget and encourage you to get in touch with our team.

This blog was updated on: 18/10/2022

Disclaimer: The information shared on the DSA Prospect website and social media accounts (inclusive of all content, blogs, communications, graphics, guides and resources) is meant to provide helpful insight and discussion on various business and accounting related topics. It contains only general information that is subject to legal and regulatory change and is not to be used as an alternative to legal or professional advice. DSA Prospect Limited accepts no responsibility for any actions you take, or do not take, based on the information we provide and we always recommend that you speak with qualified professionals where necessary before making any decisions.